Fund manager bets on economic reforms by buying lira-denominated bonds

January 18, 2024, Financial Times

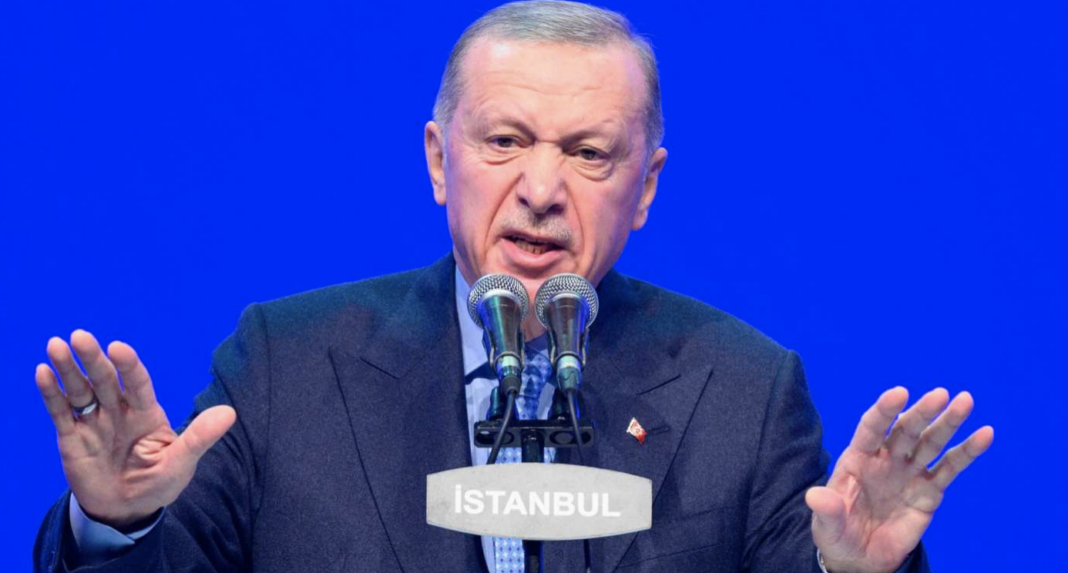

Pimco has been wading into Turkey’s bond market, betting that President Recep Tayyip Erdoğan’s commitment to a sweeping economic overhaul has set the country on a path to regaining its investment grade credit rating.

The California-based firm, one of the world’s biggest bond fund managers, has been buying Turkey’s lira-denominated debt since the second half of last year, prompted by Erdoğan’s abrupt change of economic policy after his victory in May’s general election.

“Interest rates have risen substantially, fiscal policy has tightened . . . policymakers continue to unwind unsustainable programmes, encouraging locals to invest back into the lira and away from US dollars . . . these efforts are working,” said Pramol Dhawan, who heads the firm’s emerging markets team.

The fund firm was “very constructive” on domestic Turkish assets, he added.

A return to investment grade status for Turkey would mark a dramatic turnaround from before the election, when many economists were fretting about the risks that the country would face a balance of payments crisis or be forced to impose capital controls. Such an upgrade could happen “within the next five years if everything goes to plan”, said Dhawan.

Turkey currently holds a single B rating across the major agencies, five or six notches into junk status, having lost its investment grade designation in the wake of a 2016 failed coup attempt against Erdoğan.

Moody’s Investors Service last Friday upgraded its outlook on Turkey to positive, suggesting it could soon lift its B3 rating. It cited “signs that inflation dynamics are starting to turn, indicative of monetary policy regaining credibility and effectiveness”.

Investors’ and analysts’ more constructive outlook on Turkish assets has come as Erdoğan’s new economic team, appointed in June, has reversed many of the unconventional monetary and fiscal policies that had sent foreign investors fleeing in recent years.

The central bank, led by former Goldman Sachs banker Hafize Gaye Erkan, has lifted its main interest rate to 42.5 per cent from 8.5 per cent last summer in an attempt to cool price growth, which peaked at an annual rate of more than 80 per cent in 2022. Erkan’s rate rises sparked a sell-off in Turkish government bonds, sending yields rising and heightening their allure for foreign fund managers.

Policymakers have also taken steps to rebuild Turkey’s seriously depleted foreign currency war chest and have increased taxes to slow runaway domestic demand. They have also eased up on a costly programme to defend the lira, which has tumbled almost 40 per cent in the past year to a record low of about TL30 against the US dollar.

“Turkey is likely to attract foreign capital once again, helping to stabilise the lira, which is a necessary precondition for bringing down inflation,” Dhawan said.

There are early signs foreign investors are being tempted back after almost entirely abandoning the market in recent years. Foreign fund managers have bought about $2bn in lira-denominated Turkish government bonds since the start of June, central bank data shows.

Erkan, who met investors at an event arranged by JPMorgan in New York last week, has vowed to keep monetary policy tight as long as needed to restore price stability. The central bank expects inflation, which is running at nearly 65 per cent, to begin easing in the second half of this year.

One person who attended last week’s event said Erkan and finance minister Mehmet Şimşek, who appeared virtually, “delivered a very credible and encouraging update on the impact of their reforms and goals looking forward”.

Still, many investors remain cautious on Turkey, pointing out that Erdoğan has in the past made numerous abrupt changes in economic policy and sacked central bank chiefs for increasing interest rates. Local elections in March are seen as an important test of whether Turkey’s leader, who has been in power for the past two decades, will be willing to stick to the new programme.

“Investors are closely monitoring Turkey’s economic policy due to the recent high turnover of central bank governors,” Dhawan said. However, “currently the market is optimistic about Turkey’s commitment to the adjustment process,” he added.